AI for Fraud Prevention: Identifying OFAC Blocked Persons

AI for Fraud Prevention: Identifying OFAC Blocked Persons

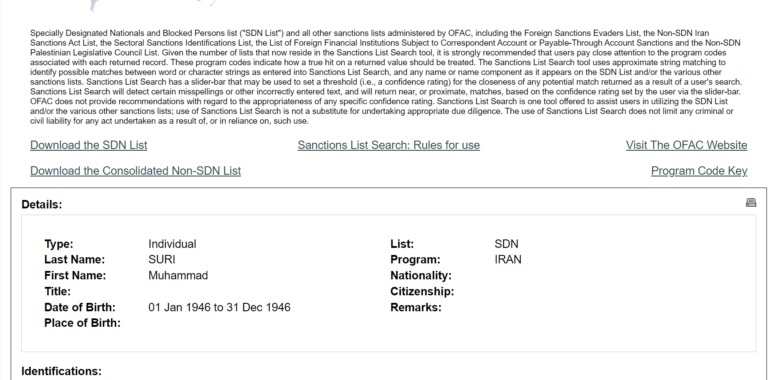

The Office of Foreign Assets Control (OFAC) maintains a list of individuals and entities that are subject to economic sanctions based on U.S. foreign policy and national security goals. For example, if someone has been identified as financially supporting terrorism or engaging in activities that threaten national security, they would be on this list. Lenders are required to check all loan participants (borrower, realtor, loan officer, processor, underwriter, title closer, title company, etc) before the loan closes to ensure they are not on this list.

The list is searchable on the OFAC website and includes textual based information such as names, aliases, dates of birth, etc. The problem with this list is that when you do encounter a name match, it’s difficult to prove this person is or isn’t the person on the OFAC list. The OFAC list typically contains people in foreign countries. While it is usually unlikely that someone involved with the loan is the same person with the same name on the list who is located in Serbia, how would you REALLY know? How do you prove that? And truthfully, there is little incentive for the lender to dig deep into this. They essentially want to close the loan and get paid their commissions. Plus who is really going to call the title closer and ask them if they are on the OFAC blocked list?

One way to solve this is a three step process. First, require biometric data, ie face images, for all people involved in the loan. This biometric data would be stored with the loan file. Second, have the OFAC office link photos of the OFAC Block Listed people to their names in the database. Third, use AI Computer Vision to compare facial biometrics of loan participants to the people on the OFAC list. This would be a much more effective search that trying to match simply on names alone.

If OFAC didn’t want to publish the pictures in their online database, they could provide an API. Loan systems could send the photos of loan participants to the API, which would then run AI Computer Vision algorithms to determine if there was a match. Any matches found was cause notifications to be sent to lender management and government officials.

Overall, ‘people lookup’ based on textual name matches is not efficient or even useful when the database contains people from a global search.